This semester I get to teach Economic Geography, a Sophomore-level course in our International Studies program. I use World Systems and World History perspectives, both of which favor a global scale of analysis (the course textbook is Knox, Agnew & McCarthy’s The Geography of the World Economy). This week I presented on Mercantilism, which designates both the dominant political-economic doctrine of the 17th and 18th centuries (as hegemonic a doctrine in its day as Neoliberalism is today) and a set of trade practices institutionalized by European maritime powers. Our current globalized capitalist world economy was built on Mercantilist foundations, put in place in the first phase of global European expansion, the second phase being that of the formal European empires of the industrial age. In the case of the “New World” in the Americas, Europe’s Mercantilists were creating entirely new trade networks and hinterlands. In the Old World of Afro-Eurasia however, Europe was rearranging the existing, much older, world economy it had been part of since the Middle Ages (see Andre Gunder Frank’s Re-Orient and Jim Blaut’s The Colonizer’s Model of the World). I wanted to illustrate this first phase of global capitalism with thematic maps.

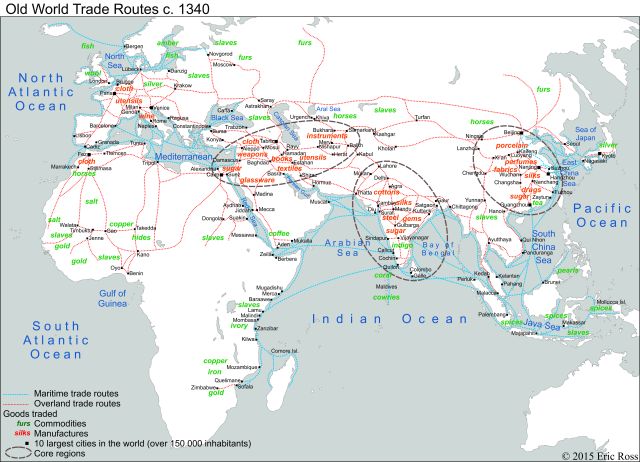

Long before Europe ventured across the world’s oceans in the 15th-16th century it was already enmeshed in long-distance trade (Abu-Lughod, Before European Hegemony). I mapped the Afro-Eurasian trade routes of the mid-14th century, a time when Atlantic Europe was a periphery, at the northeastern extremity of a system of overlapping trade networks which extended as far as Japan, Indonesia, Zimbabwe and Mali. Together, these trade relations created a single world economy.

Long before Europe ventured across the world’s oceans in the 15th-16th century it was already enmeshed in long-distance trade (Abu-Lughod, Before European Hegemony). I mapped the Afro-Eurasian trade routes of the mid-14th century, a time when Atlantic Europe was a periphery, at the northeastern extremity of a system of overlapping trade networks which extended as far as Japan, Indonesia, Zimbabwe and Mali. Together, these trade relations created a single world economy.

I chose the symbolic date of 1340 for this map because it corresponds to the travels of Ibn Battuta (1304-1369), who visited most of the world economy’s core lands and many of its peripheries. This Moroccan faqih traveled along the trade routes of his day, both over-land and across the seas, paying his way as he went, sharing the trip with merchants and pilgrims. 1340 also falls just before the Black Plague ravaged major population centers across the system.

I have distinguished the goods traded into “commodities” (in green) and “manufactures” (in orange). This highlights the “core” status of China, India and the Middle East within the world economy. Semi-peripheries at this time included North Africa, parts of western Europe (Italy, Flanders), and Java.

Among manufactures, I have included sugar, being the refined crystal shipped in loaves. I classify it as a manufacture rather than as a commodity because the manufacturing process involved in producing it (land, labor, fuel, transportation) was every bit as “industrial” as the production of iron, or steel, or cloth. I will get back to sugar production in a future post.

Among commodities, I have included slaves. As laborers (domestic, agricultural, sexual, military), the enslaved are clearly “labor,” but when they are being transported, usually in bulk, weighed in markets, and their price negotiated over, then they are just as clearly a “commodity.” Nearly every “periphery” participated in the procurement of this human commodity for the “cores” of the world economy. I will get back to slavery in a future post.

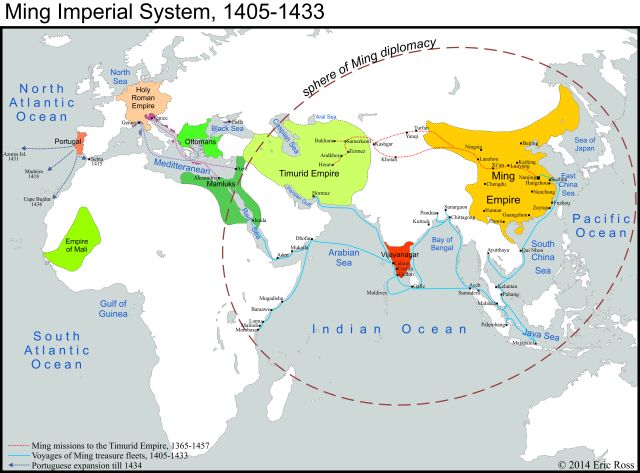

Blaut (1993) and Frank (1998) argue that Atlantic Europe was is no way predestined to start taking command of the world economy in the 15th century. If any part of the system was perhaps structurally predisposed to do so it was China. Ming China was by far the greatest empire of its day, with the largest population, the largest economy, the most advanced technologies, and the largest and most diversified production of manufactures in the world.

Blaut (1993) and Frank (1998) argue that Atlantic Europe was is no way predestined to start taking command of the world economy in the 15th century. If any part of the system was perhaps structurally predisposed to do so it was China. Ming China was by far the greatest empire of its day, with the largest population, the largest economy, the most advanced technologies, and the largest and most diversified production of manufactures in the world.

Between 1405 and 1433 China did in fact intervene in the world economy to realign it in its interest. Over the course of those decades, China sent a series of “Treasure Fleets” commanded by Admiral Zheng He (1371-1433) across the South China Sea and throughout the Indian Ocean to Arabia and East Africa (see Levathes, When China Ruled the Seas). These were diplomatic missions, laden with high quality silks, porcelains, perfumes, medicines… to be given liberally to rulers and grandees of states right across the system, all the way to the Mamluk and Timurid empires. This new diplomatic structure was successful in that it endorsed the existing principle of freedom of trade at sea then in place. This principle allowed a trade regime where traders from any port could trade freely in any other.

Meanwhile, in Atlantic Europe, Portugal, having taken Sebta/Ceuta from the Moroccans (1415), was engaging in its first oceanic acquisitions (Madeira, Azores Isl.). This was the beginning of the creation of the European Atlantic. For the time being however, Europe’s connections to global trade in manufactures still ran east through the Mediterranean. Venetian merchants bought silks and spices in Mamluk ports and the Genoese did the same in Ottoman ones. They then sold these on to German merchants in Italy, who then took them to over-land markets across the Alps. These trade relations had been operating for centuries.

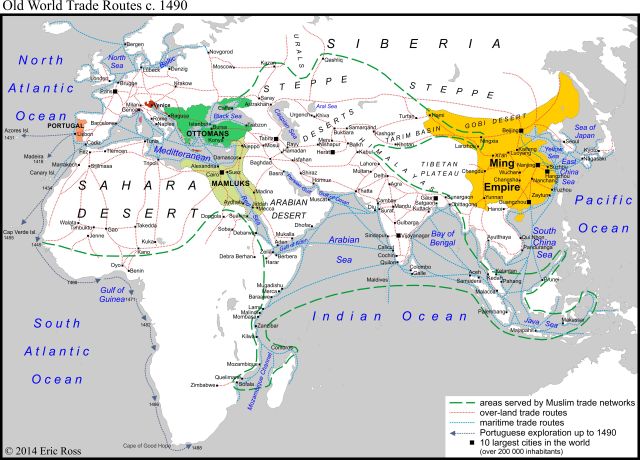

The Mamluks and the Ottomans were very effective at keeping Italian merchants from trading, or even traveling, inland through their realms. East of the Mediterranean and Black Sea ports, almost all the rest of the world economy was operated by Muslim merchant networks. This is largely because the area we call today “the Middle East” (Arabia, the Red Sea, the Persian Gulf, Egypt, the Levant, Turkey, Iran) constituted the central crossroads of the world trading system, where major sea lanes and land routes converged. At least by the heyday of the ‘Abbasid Caliphate (9th century), Muslim merchants from these lands were traveling to Russia, West and East Africa, India and China. By Ibn Battuta’s day, most trans-continental and trans-oceanic trade in the world economy’s overlapping networks was conducted by Muslim traders. In Islam, these international traders found a common legal system, common mathematics and accountancy, and a commercial ligua franca in Arabic. This allowed the trading system to operated quite well across multiple, sometimes ephemeral and often warring states. And it did so without any type of international institution overseeing it (Graeber, Debt).

The Mamluks and the Ottomans were very effective at keeping Italian merchants from trading, or even traveling, inland through their realms. East of the Mediterranean and Black Sea ports, almost all the rest of the world economy was operated by Muslim merchant networks. This is largely because the area we call today “the Middle East” (Arabia, the Red Sea, the Persian Gulf, Egypt, the Levant, Turkey, Iran) constituted the central crossroads of the world trading system, where major sea lanes and land routes converged. At least by the heyday of the ‘Abbasid Caliphate (9th century), Muslim merchants from these lands were traveling to Russia, West and East Africa, India and China. By Ibn Battuta’s day, most trans-continental and trans-oceanic trade in the world economy’s overlapping networks was conducted by Muslim traders. In Islam, these international traders found a common legal system, common mathematics and accountancy, and a commercial ligua franca in Arabic. This allowed the trading system to operated quite well across multiple, sometimes ephemeral and often warring states. And it did so without any type of international institution overseeing it (Graeber, Debt).

While Atlantic Europe craved the spices and adored the silks of “the Orient” that it bought in Levantine ports, it had few fine manufactures of its own to offer in return. The fine woolen cloth of Flanders, as fine as it was, was not a good fit for markets in the hot and arid Middle East, nor could the array of fine alcoholic beverages it produced find many buyers in Muslim markets. For the most part, western Europe had to purchase what it wanted in hard currency, silver coin mostly, mined in Bohemia, most of which eventually ended up in China. This was the biggest brake on Europe’s ability to consume Asian luxuries, and indicative of its “periphery” rank in the system.

The world economy’s other western peripheries, West Africa and East Africa, were the system’s greatest producers of gold. Mali and Zimbabwe exported gold as a commodity to North Africa and the Middle East, where it was minted into currency, which then circulated eastward across Central Asia and the Indian Ocean, much of it eventually ending up in India. The prosperity of Middle Eastern cities, at the crossroads of long-distance trade, was thus greatly enhanced by having both Europe’s silver and Africa’s gold circulate through their markets on their way east.

1490 marks the last convenient date for a “before” European world. In 1493 Christopher Columbus returned to Spain with news of a new empire to be had, and in 1499 Vasco de Gama returned to Portugal from his more-or-less successful trip to India. Genoese bankers, seeking to circumvent the Mamluk and Ottoman barrier to the trade with Asia, had in fact backed both countries’ Atlantic ventures.

I call Vasco de Gama’s voyage to South India more-or-less successful because, when he got to Calicut he found that his stock of miserable Portuguese exports (which found markets in West Africa in exchange for slaves and gold) became the laughing-stock of Indian merchants. Whether in the old Levant or the new one, in 1498 Europe still produced little of value to the world economy’s core regions.

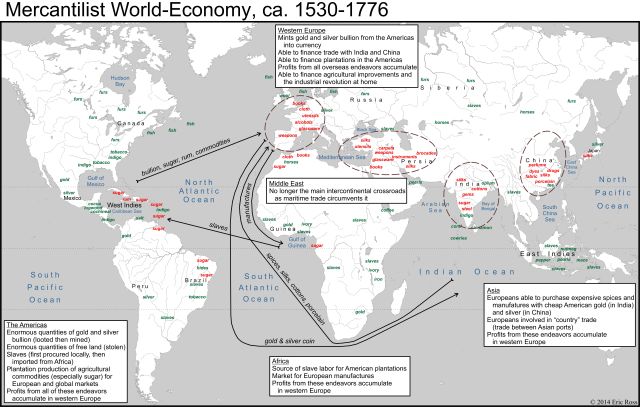

What ensued in the century after 1490 was the foundation of the European world economy, the global one we still live in. First, Atlantic Europe created a European Atlantic, one whose most lucrative trade configuration was the infamous “Triangular Trade” with Africa and America. The Portuguese and the Spanish unlocked that ocean’s trade winds and currents to create a whole new maritime trading sphere, one with Europe at the core. Gold and silver (first looted, then mined by slaves) from Mexico and Peru was shipped to Spain, where it was minted. Most of the new currency was sent to Genoese banks, some of them in Antwerp, from where it then circulated through northern Europe and the Baltic. And some of the new currency was sent to Lisbon, loaded onto ships bound for the “East Indies” to buy manufactures and spices.

What ensued in the century after 1490 was the foundation of the European world economy, the global one we still live in. First, Atlantic Europe created a European Atlantic, one whose most lucrative trade configuration was the infamous “Triangular Trade” with Africa and America. The Portuguese and the Spanish unlocked that ocean’s trade winds and currents to create a whole new maritime trading sphere, one with Europe at the core. Gold and silver (first looted, then mined by slaves) from Mexico and Peru was shipped to Spain, where it was minted. Most of the new currency was sent to Genoese banks, some of them in Antwerp, from where it then circulated through northern Europe and the Baltic. And some of the new currency was sent to Lisbon, loaded onto ships bound for the “East Indies” to buy manufactures and spices.

Atlantic Europe now assumed the position in the world economy that the Middle East had held previously; the new gold and silver entered Europe as a commodity, as bullion. The coins minted from these precious metals then circulated through European markets and empowered European merchant networks, who circulated it east to the traditional currency sinks of China and India. The new type of merchant network in Atlantic Europe was the chartered company, a company of private shareholders chartered by the crown to exercise a monopoly of trade over some loosely-defined region of the world, such as: “the East Indies,” “Guinea,” “Hudson’s Bay,” “Mississippi,” or “the South Seas.” The royally-chartered, privately owned, joint-stock trading companies of Mercantilist Europe were the forerunners of today’s Trans-National Corporations.

With bullion from the Americas flowing in, Europe could now afford to buy ever greater quantities of cotton and silk fabrics, porcelain and spices directly in Asian ports through its various “East Indies” companies. European traders (“factors,” agents of the chartered monopoly firms) in Asian ports were not only empowered by cash-flow, they could also count on gun-boat diplomacy, relying on their national navies to force their way into Asian markets.

Europe’s rise in rank in the world economy wasn’t only due to American bullion. There was also the abundant free land to be had there—free, that is, once you had removed or enslaved the population. Stolen land and abundant slave labor (first Native American, then African) soon translated into plantation production of agricultural commodities: tobacco, cacao, indigo, but especially sugar. These new commodities too flowed to Atlantic European ports, especially once the Dutch, the English and the French got in on the action at the turn of the 17th century.

In short, by the 17th century, in order to be a successful Mercantilist power, a European state had to build a merchant fleet, back it up with a navy, secure commodities in the Americas and slave labor in Africa, and have the currency to purchase high quality manufactures in Asia.

For over two centuries, profits from all of these lucrative overseas endeavors, those of the Portuguese and Spanish, of the Dutch and the French and the English (and of a few others) accumulated in Atlantic Europe. Much of this capital was reinvested in yet more lucrative overseas ventures, but some of it was invested at home, in agricultural improvements. This also contributed to western Europe’s economic growth in the Mercantilist era (Braudel, Civilization & Capitalism). Eventually, in late 18th century Britain, some of the profits from oversea ventures was invested in the production of manufactures (textiles). Thus, not only did the merchant capitalism of the Mercantilist era create a truly global, European-centered world economy, it provided much of the capital necessary to start industrial manufacturing, and the Industrial Revolution (see Eric Williams’ Capitalism and Slavery). When that happened, policies favored by industrial capitalists in Atlantic Europe began to win out over those favored by its merchant capitalists. Mercantilism, as a doctrine, a set of policies and a set of practices, was dropped. The date 1776 best marks this rupture. Revolution in the Thirteen Colonies was provoked as much by resentment to Britain’s Mercantilist practices (protectionism, monopolies) as it was by its taxation policies. 1776 is also when Adam Smith published The Wealth of Nations, which amounted to an indictment of Mercantilism.

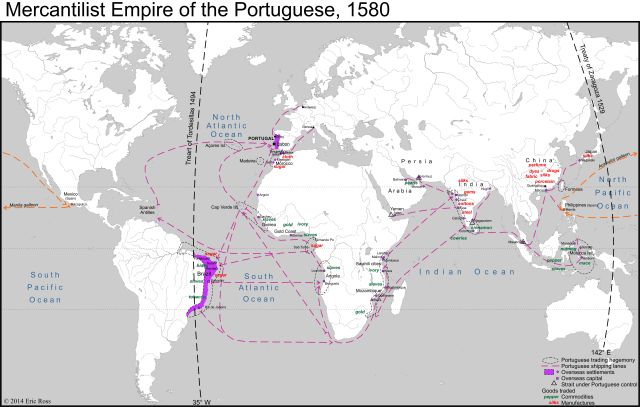

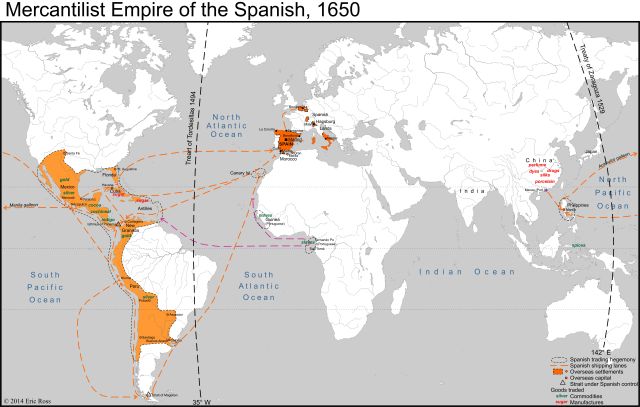

At first, the Iberian powers: Portugal and Spain, had everything their way. Early on they came to an agreement, endorsed by the Pope in Rome, that pretty much divided the planet between them. The Treaty of Todesillas (1494) delimited a meridian through the Atlantic Ocean, equivalent to 35° W. East of this meridian (Brazil, Africa, India and Indonesia) was a Portuguese maritime monopoly and everything west of it (the Americas minus Brazil) was a Spanish monopoly. In 1529 they signed the Treaty of Zaragoza, which basically used the 142° E meridian in the Pacific Ocean for the same purpose.

At first, the Iberian powers: Portugal and Spain, had everything their way. Early on they came to an agreement, endorsed by the Pope in Rome, that pretty much divided the planet between them. The Treaty of Todesillas (1494) delimited a meridian through the Atlantic Ocean, equivalent to 35° W. East of this meridian (Brazil, Africa, India and Indonesia) was a Portuguese maritime monopoly and everything west of it (the Americas minus Brazil) was a Spanish monopoly. In 1529 they signed the Treaty of Zaragoza, which basically used the 142° E meridian in the Pacific Ocean for the same purpose.

Once the Portuguese entered the Asian trade, that small country created Europe’s first Mercantilist empire with astonishing rapidity. The Portuguese started by conquering and fortifying nearly every major strategic trading port and navigation strait around the Indian Ocean: Kilwa and Mombasa (1505), Goa and Calicut (1510), Malacca and Ambon (1511), Hormuz and Bahrain (1515), Colombo (1518), Ternate (1522), Aden (1524), Ningbo (1533), and Diu (1535). This created a network of fortified trading ports from which they attempted to enforce their self-declared monopoly over maritime trade. They called “their” ocean a mare clausum (a “closed sea”), closed to all but Portuguese trade. They insisted that only ships with a cartaz (a permit which only the Portuguese crown could issue) were permitted to trade in it.

The Portuguese never succeeded in imposing their claim to monopoly, either on the merchants of the Indian Ocean or on the other European merchants who soon followed them there, but they did succeed in violently disrupting pre-existing trade relations. In an effort to enforce their declared monopolies against all comers, the Portuguese waged war right across the ocean from Africa to Indonesia, ending the institution of freedom of trade at sea which had thrived there. The Portuguese state saw this as an extension of the Iberian Reconquista against the Muslims/Moors. They encountered “Moors” everywhere, in Morocco and Guinea and East Africa and the Philippines. This is because, for centuries prior to their arrival, the maritime trade networks across this vast area were operated by Muslim merchants.

In the Atlantic Ocean, the Portuguese claimed a similar monopoly along Africa’ coastal coasts, particularly over the Guinea Coast and Congo-Angola where they procured slaves. The enslaved were shipped to plantations in Saõ Tome, Madeira and Brazil to produce commodities such as sugar and tobacco.

The Spanish took a little longer to set their hemispheric system up. Columbus’s initial landfalls in the Caribbean in the 1490s didn’t produce the amounts of gold the Spanish crown had been hoping for. However, once the Spanish conquistadors had overthrown the empires of the Aztecs (1520) and the Incas (1533), looted gold flowed across the Atlantic, soon to be followed by yearly convoys of silver mined in Mexico and Peru and shipped, en masse as bullion, from Havana. Meanwhile, the Spanish were establishing sugar plantations in the islands of the Caribbean, in Cuba and Hispaniola (modern Dominican Republic) especially.

Portugal and Spain were partners in the spoils/opportunities the new global world economy provided, and they cooperated in its management. For instance, for their plantations in the Americas the Spanish could rely on regular supplies of slaves from the Portuguese in Guinea and Angola. In turn, to finance their acquisition of manufactures in China and Japan, the Portuguese relied on a regular supply of silver from Spanish Mexico. The Spanish sent this silver directly across the Pacific to Manila in a yearly convoy (the “Manila Galleon”). This was an outcome of the 1529 Zaragoza Treaty; Portugal retained Japan (east of its 1494 share) while Spain retained the Philippines (west of its 1492 share).

The monopolistic bases of the 16th-century Iberian system created many enemies, not least among Iberia’s neighbors in Atlantic Europe. The Dutch, the French and the English crowns started financing exploration expeditions to parts of the world’s coasts not yet policed by the Portuguese and the Spanish. They created merchant fleets and ocean-going navies of their own. And they chartered “privateers” (licensed pirates) to attack the Iberians and trade in “newly found” territories. To the Portuguese and Spanish authorities, all these interlopers were “pirates,” breaking a legal (to them) monopoly of trade in their mare clausum.

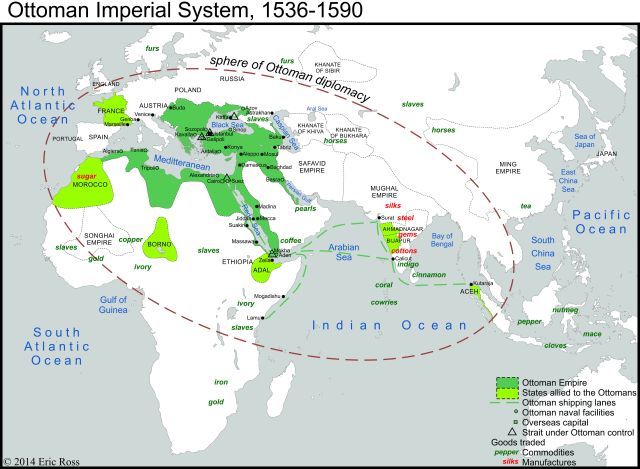

The Portuguese also faced resistance from powers in the “old” parts of the world economy. When armed Portuguese ships arrived in the Red Sea and threatened Jiddah and the holy cities of the Hijaz, the Mamluks reposted with attacks on Portuguese positions as far as the coast of India (1509). When the Mamluks were defeated by the Ottomans and their territories absorbed into the Ottoman Empire (1518), it is the powerful Ottoman fleet that took on the Portuguese in the Indian Ocean (see Giancarlo Casale’s The Ottoman Age of Exploration).

The Portuguese also faced resistance from powers in the “old” parts of the world economy. When armed Portuguese ships arrived in the Red Sea and threatened Jiddah and the holy cities of the Hijaz, the Mamluks reposted with attacks on Portuguese positions as far as the coast of India (1509). When the Mamluks were defeated by the Ottomans and their territories absorbed into the Ottoman Empire (1518), it is the powerful Ottoman fleet that took on the Portuguese in the Indian Ocean (see Giancarlo Casale’s The Ottoman Age of Exploration).

The Ottomans fought the Portuguese and their Spanish allies on many fronts: along the borders of Austria, across the length of the Mediterranean Sea, as well as in the Indian Ocean. It was during the administration of Sokollu Mehmed Paşa in particular (Grand Vizir 1565-1579) that Ottoman diplomacy developed its greatest reach. Its network of allies and its “soft power” influence (consisting of military advisers, arms exports, and loans) reached from Sa’dian Morocco and Valois France to Somalia and Aceh (modern Indonesia). The Ottomans found ready allies everywhere, as the pretentions of Portuguese monopoly, with its hated cartaz and gun-boats, were a structural source of violence in the trading system and were hindering normal maritime commerce. The immediate aim of the Ottomans was to preserve “their” Red Sea trade route to the spices of Indonesia. In this they succeeded. More broadly, they attempted to establish a diplomatic regime over the Asian core of the world economy that would reinstate the freedom of trade regime that had thrived there prior to the arrival of the Portuguese. In some ways, the Ottoman diplomatic initiative resembled that of the Ming a century and a half earlier.

In the end, the Ottomans failed to dislodge the Portuguese from the Indian Ocean and to reinstate an “open” trading regime there. In the 1580s, the Ottoman fleets retreated to the Red Sea, leaving the rest of the ocean to the devices of the Portuguese. Had they kept up their resistance there a little longer, the Ottomans may well have succeeded in their larger aim. By the turn of the 17th century the Portuguese were facing a growing array of enemies around the world with which the Ottomans could have found allies. For instance, because of their slave raiding and disruptive religious proselytism, the Portuguese became very unwelcome in Japan. That country expelled them in the 1580s and thereafter, among European nations, it would only trade with the Dutch, and even the Dutch traders were confined to a tiny islet-quay called Dejima in the port of Nagasaki. In 1545 the Chinese had likewise expelled Portuguese traders from Ningbo and confined them to the island of Macao near Guangzhou.

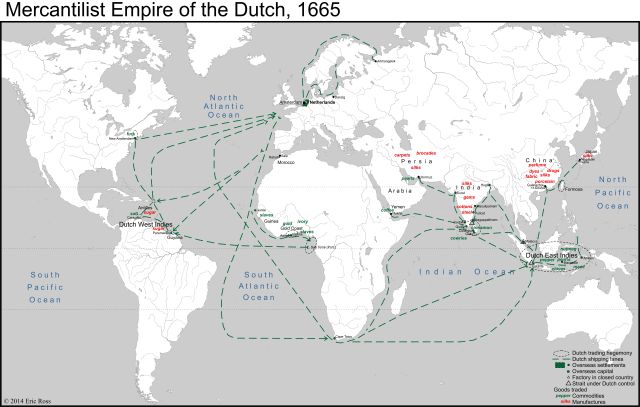

The biggest new player on the world’s seas in the 17th century was the Netherlands, an Atlantic European country even smaller than Portugal. The Dutch cities were still fighting their “Long War” (1568-1648) to free themselves from Spanish rule when they embarked upon Mercantilist empire-building. They began by attacking Spanish shipping in the North Atlantic, especially the bullion-laden galleons arriving from America. When, in 1580, the Spanish and Portuguese crowns were united under a single king, the Dutch took on the Portuguese Empire as well. At sea, they confronted the Portuguese at many points, in Brazil, along the Guinea Coast, and in the East Indies. They managed to oust the Portuguese from many key ports (Elmina, Malacca, Colombo) and replace Portuguese trading hegemony with their own (particularly in southern India and the lucrative “spice islands” of Indonesia). They also established the towns of New Amsterdam (1624, now called New York) in North America and Cape Town (1652) in southern Africa.

The biggest new player on the world’s seas in the 17th century was the Netherlands, an Atlantic European country even smaller than Portugal. The Dutch cities were still fighting their “Long War” (1568-1648) to free themselves from Spanish rule when they embarked upon Mercantilist empire-building. They began by attacking Spanish shipping in the North Atlantic, especially the bullion-laden galleons arriving from America. When, in 1580, the Spanish and Portuguese crowns were united under a single king, the Dutch took on the Portuguese Empire as well. At sea, they confronted the Portuguese at many points, in Brazil, along the Guinea Coast, and in the East Indies. They managed to oust the Portuguese from many key ports (Elmina, Malacca, Colombo) and replace Portuguese trading hegemony with their own (particularly in southern India and the lucrative “spice islands” of Indonesia). They also established the towns of New Amsterdam (1624, now called New York) in North America and Cape Town (1652) in southern Africa.

While Dutch chartered companies held monopolies in various parts of the empire, the Dutch claimed no overall monopoly of trade in the oceans as the Portuguese had. On the contrary, once freed of Spanish rule (1648) and able to exploit their newly created empire, the Dutch espoused mare liberum (freedom of the seas). First expounded by the jurist Hugo Grotius in 1609 in direct rebuttal to Portugal’s mare clausum policy, this principle claimed that the ships of all nations were free to trade anywhere. This was, of course, the very same principle that had pertained in the Indian Ocean and Chinese seas prior to Portugal’s ventures there.

The Netherlands were at the forefront of institutional innovation in the European world economy. Though still chartered monopolies, the Dutch overseas trading companies were joint-stock ventures whose shares were traded in the Amsterdam stock exchange, the first of its kind anywhere (1602). The Amsterdam Stock Exchange became famous for the Tulip Bubble of 1637. It nonetheless remained the biggest stock exchange in Europe well into the 18th century. The largest of the companies traded there was the Vereenigde Oost-Indische Compagnie (United East Indies Company), chartered in 1602, whose monopoly in trade extended from South Africa to Japan.

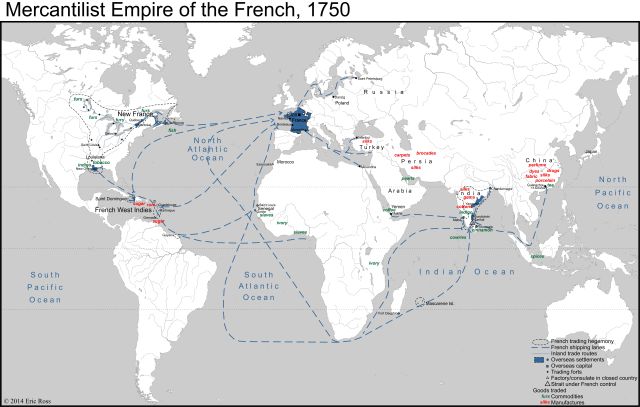

The Kingdom of France, the biggest economy in Europe, also acquired a Mercantilist empire in the 17th century. The French established plantation colonies in the Caribbean, in Martinique and Guadeloupe (1635), and in Saint-Domingue (established by French privateers in 1625). Their colony of Saint-Domingue (modern Haïti) became the single most lucrative colony in the world in the 18th century. To supply these sugar-colonies with slaves, the French established comptoirs (“factories,” trading towns governed by a company agent) in Senegal: Saint-Louis (1659) and Gorée (1677). On this particular “slave coast,” the French company competed with Dutch and English companies, as well as with the Portuguese.

The Kingdom of France, the biggest economy in Europe, also acquired a Mercantilist empire in the 17th century. The French established plantation colonies in the Caribbean, in Martinique and Guadeloupe (1635), and in Saint-Domingue (established by French privateers in 1625). Their colony of Saint-Domingue (modern Haïti) became the single most lucrative colony in the world in the 18th century. To supply these sugar-colonies with slaves, the French established comptoirs (“factories,” trading towns governed by a company agent) in Senegal: Saint-Louis (1659) and Gorée (1677). On this particular “slave coast,” the French company competed with Dutch and English companies, as well as with the Portuguese.

In North America, where they also competed with the Dutch and the English, the French anchored a vast continental commercial hinterland with three settler colonies: Canada (modern Québec, 1608), Acadia (1604) and Louisiana (1718). Inland trade was conducted by river navigation (canoe & portage) secured with fortified posts: Detroit (1701), another Saint-Louis (1764), and Fort Duquesne (Pittsburg, 1754).

France was equally successful in India (Pondicherri, 1674), though it was a latecomer there. Dutch and the English companies were already competing with the Portuguese in India when la Compagnie française pour le commerces des Indes orientales was chartered in 1642. By the middle of the 18th century however, that Company’s commercial, diplomatic and military hinterland extended over much of the Deccan, surpassing all its rivals.

The French conducted trade with China under the same conditions as did the Dutch, the English and the various other European nations, all quarantined on a single quay, called the “Thirteen Factories,” in the port of Guangzhou. The newly established Qing Dynasty sought to limit contact with European Mercantilism in this way.

French institution-building initiatives were not as successful as those of the Dutch and the English. The first central bank, the Banque Générale, was established in 1716. While private, its capital came from state revenues. It collapsed in 1720 when the Mississippi Company’s bubble burst catastrophically (also known as the Louisiana Bubble).

The French had greater success institutionalizing another Mercantilist policy, import-substitution. Import-substitution was one of Jean-Baptiste Colbert’s main policies while minister of finance (1665-83) for Louis XIV. Royally-endowed glass works were established in Saint-Gobain (1665) to compete with glassware from Venice, the import of which was then forbidden. Tapestry works were established at Gobelin. The import of silks was banned to protect the silk manufacturers of Lyon and, later, ceramic works were established in Limoges (1771). The French state used import-substitution to reduce its trade deficit with India and China (mostly because in needed its currency reserves to finance expensive wars in Europe). Embargoes on the imports of luxury manufactures from Asia were not air-tight. For example, Madame de Pompadour, Louis XV’s beautiful official mistress (1745-64), pointedly appeared at court in gowns cut only from authentic Indian fabrics. Nonetheless, import-substitution worked. Made-in-France silks, porcelains, glassware and other manufactures, backed by state capital, dominated the French market and were traded throughout Europe, where they competed with Asian luxury goods. These young French manufactures also benefited from a monopoly over “overseas” French markets, especially in American colonies. France’s luxury industries were given a great boost by the protectionist policies of the Mercantilist era.

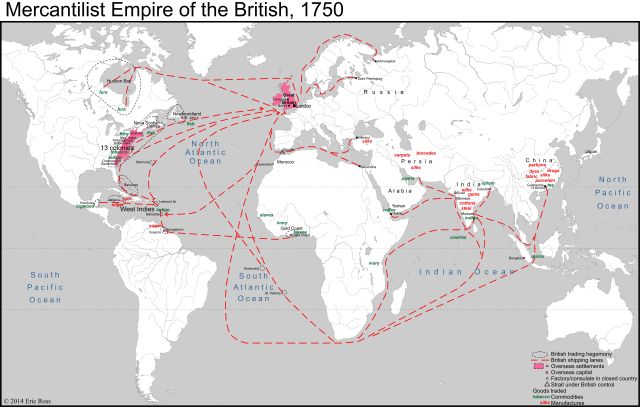

The English (British after the 1707 Acts of Union), like the Dutch and the French, built a successful Mercantilist empire on the ruins of Portuguese and Spanish pretentions to global duopoly. While in Europe the British steadfastly supported the Dutch Republic against France, in their Mercantile empire British companies proved as willing and able to conquer Dutch possessions as they were those of the French, or of the Spanish. The 18th century was a global free-for-all of ferocious Mercantilist competition between emerging European Nation-States. It was highly unstable and caused repeated bouts of war in Europe and “overseas:” The War of the Grand Alliance (1688-97), The War of Spanish Succession (1701-14), The War of Austrian Succession (1740-78), The Seven Years War (1756-63). These were already “world wars” avant la letter. Atlantic European powers fought each other in India and South East Asia, on Africa’s Atlantic coasts, in the Caribbean and in North America. Some of their colonies in these areas changed hands many times.

The English (British after the 1707 Acts of Union), like the Dutch and the French, built a successful Mercantilist empire on the ruins of Portuguese and Spanish pretentions to global duopoly. While in Europe the British steadfastly supported the Dutch Republic against France, in their Mercantile empire British companies proved as willing and able to conquer Dutch possessions as they were those of the French, or of the Spanish. The 18th century was a global free-for-all of ferocious Mercantilist competition between emerging European Nation-States. It was highly unstable and caused repeated bouts of war in Europe and “overseas:” The War of the Grand Alliance (1688-97), The War of Spanish Succession (1701-14), The War of Austrian Succession (1740-78), The Seven Years War (1756-63). These were already “world wars” avant la letter. Atlantic European powers fought each other in India and South East Asia, on Africa’s Atlantic coasts, in the Caribbean and in North America. Some of their colonies in these areas changed hands many times.

The English took their share of West Indian sugar-islands (Jamaica, 1655) from the Spanish, but they were especially successful in establishing 13 settler colonies along North America’s Atlantic seaboard: Virginia (1607), Massachusetts (1620), South Carolina (1670), Pennsylvania (1681), Georgia (1733)…, evincing the Danes and the Dutch in the process, and competing with French companies in the interior.

In India, the English East India Company acquired three major factories: Madras (1639), Bombay (1661), and Calcutta (1712), destined to become the main cities of its 19th century empire.

England was no free-trade advocate when it set out to create its Mercantilist empire. Starting in 1651 it enacted Navigation Acts which restricted access of foreign ships to English goods in home ports, and to even call at English ports “overseas.” This was a reaction to the growth of Dutch trade. These protectionist measures accorded well with the theories of Thomas Mun, the Director of the English East India Company who had been appointed to the government’s Standing Committee on Trade in 1622. The Navigation Acts greatly bolstered England’s merchant navy and permitted it to compete with the Dutch and the French on all the seas. English goods, too, were given a monopoly over captive colonial markets. Emerging markets in the 13 American colonies especially resented these laws.

Like the Netherlands, Britain developed corporate institutions for the Mercantilist age which are still with us. The Bank of England was chartered in 1694. It was composed of a group of private stockholders (bankers) and held a monopoly on the issuing of banknotes in England and Wales. The Bank of England subsequently became a model for central banks everywhere. The transactions of maritime merchants meeting over coffee at Lloyd’s Coffee House, in London, eventually led to the establishment of Lloyd’s of London, an insurance company. Lloyd’s held an un-chartered monopoly on insuring British slave-ships in the Atlantic until the abolition of that trade in 1807. The Royal Exchange (forerunner of the London Stock Exchange), was chartered by Queen Elizabeth I in 1571. It operated from Johnathan’s Coffee House, near the Bank of England, where stockbrokers and investors met. It was famous for such bubbles as the South Sea Company Bubble of 1720 (a double-whammy with the Mississippi Bubble unfolding in France at the time) and the Bengal Bubble of 1769 (caused by an overvaluation of British East India Company stock, based on tax revenues it was collecting in the newly conquered province of Bengal). Speculative colonial bubbles could come and go, by the late 18th century the London’s stock exchange was the largest in Europe.

Britain emerged the great victor of the Mercantilist era. The Seven Years War proved a disaster for rival France. In 1763 France lost nearly all of its empire in North America and India, and nearly all of its losses were British gains. Though Great Britain lost its 13 North American colonies in 1783, it seized African and Asian colonies from the French and the Dutch during the French Revolutionary and Napoleonic Wars (1792-1815). By 1815 Britain’s hegemony over trade in the world economy was established. By then though, Mercantilism was history, destroyed by four revolutions: the American Revolution (1775-83), the French Revolution (1789-94), the Haïtian Revolution (1791-1804) and the Industrial Revolution then unfolding in Britain itself.

By 1815 there were very few markets in the world beyond the reach of British merchants. Among these few were Japan, China and Morocco. Tokugawa Japan would only trade with the Dutch (and the Chinese), and would only do so on the island-quay of Dejima in Nagasaki harbor. In China, the factory of the British East Indies Company stood on 13 Factories quay in Ghangzhou along with those of all the other European companies (save the Portuguese, who traded on the island of Macao). The Qing Dynasty in China proved as effective at keeping European traders out as the Mamluks and Ottomans had in the 15th century. In Morocco, the ‘Alawi Dynasty confined trade with Europeans to designated consulates, first in Rabat and then in Essaouira (1762). These buildings were tiny “footholds” for Europe’s Mercantilist traders, especially when compared to the scale of the havoc they were wreaking elsewhere. The policy of limiting European trade to specified factories and consulates in singular ports allowed states like Japan, China and Morocco to protect their own trade and commerce from the violent corporate monopolies European powers were attempting to impose on all the non-European states they encountered.

In the mid-19th century, industrial capitalism, in the name of “freedom of commerce,” would use a few new rounds of powerful gun-boat diplomacy to break these three states open once and for all: Britain’s Opium Wars in China (1839-42, 1856-60), the French bombardment of Tangier and Essaouira (1844), and Commodore Perry’s threat to Edo/Tokyo (1853). By then, Britain was the “workshop of the world,” producing manufactures the whole world wanted to buy. By then it was pursuing free trade, symbolized by the abolition of slavery (1833) and the repealing of the Navigation Acts (1849). By then, the British had the largest merchant navy in the world, and its ships, laden with all sorts of Made-in-Britain manufactures, called in all the world’s ports.

Suggested reading

- Abu-Lughod, Janet (1989). Before European Hegemony: The World System A. D. 1250-1350. Oxford University Press.

- Blaut, J. M. (1993). The Colonizer’s Model of the World: Geographical Diffusionism and Eurocentric History. New York/London: The Guilford Press.

- Braudel, Fernand (1979). Civilization & Capitalism: 15th-18th Century (3 vols.). Translated by Siân Reynolds. New York: Harper & Row.

- Casale, Giancarlo (2010). The Ottoman Age of Exploration. Oxford University Press.

- Chaudhuri, K. N. (1991). Asia before Europe: Economy and Civilisation of the Indian Ocean from the Rise of Islam to 1750. Cambridge University Press.

- Frank, Andre Gunder (1998). ReOrient: Global Economy in the Asian Age. University of California Press.

- Graeber, David (2011). Debt: The First 5,000 Years. Melville House Publishing: Brooklyn, NY

- Hobson, John M. (2004). The Eastern Origins of Western Civilization. Cambridge University press.

- Ibn Fadlân, Ibn Jubayr, Ibn Battûta et un auteur anonyme (1995). Voyageurs arabes. Translated and annotated by Paule Charles-Dominique. Paris: Gallimard.

- Knox, Paul, John Agnew & Linda McCarthy (2008). The Geography of the World Economy (fifth edition). London: Hodder Education.

- Levathes, Louise (1994). When China Ruled the Seas: The Treasure Fleet of the Dragon Throne: 1405-1433. Oxford University Press.

- Pomeranz, Kenneth & Steven Topik (1999). The World that Trade Created: Society, Culture, and the World Economy 1400 to the Present. Armok/London: M.E. Sharpe.

- Rodney, Walter (1972). How Europe Underdeveloped Africa. London: Bogle-L’Ouverture Publications.

- Williams, Eric (1944). Capitalism and Slavery. University of North Carolina Press.

Reblogged this on sageinsightblog.

Amazing.. thanks!

Pingback: 31st Aug 2016 Links… | Tweedledo-ings ...

Pingback: Bookmarks for September 4th through September 5th | Chris's Digital Detritus

Pingback: “Does Anyone in Syria Fear International Law?” and other Twinks… | the rasx() context

Really good article. Thank you a lot!

Pingback: Εμπόριο, εμποροκρατία και σύγχρονο κράτος, Β΄ : ο χώρος και ο νόμος του πολέμου και του εμπορίου – The Mermaid Tavern

This is very informative summary. maps are amazing. thank you.

Thanking you for doing what you love would be disingenuous; so, I’m grateful, at least, that our lives overlapped enough to check out your work.

Reblogged this on Searing with Snooney.

Very helpful post, and the maps are especially useful!